dependent care fsa vs tax credit

Youre spending twice that so no problem there. The Dependent Care Tax Credit allowed taxpayers to claim up to 3000 of expenses for one dependent and up to 6000 in expenses for two or more dependents.

What Is A Dependent Care Fsa Wex Inc

Typically 5000 for all tax filing status except married filing separately.

. For 2021 the limit was increased to 10500 but raising the limit was left to each employers discretion. Child Care Tax Credit. You have another option for saving money on dependent care expenses via lowering your taxable income.

The maximum credit was 35 of eligible expenses resulting in a credit of 1050 and 2100 against total tax liability. I missed it when it was first announced but I just saw the changes to the dependent care FSA and dependent care tax credit and now Im not sure which would be better or if we can even change. 5000 is the maximum whether for one child or.

The Magnitude of Optimal Antenatal Care Utilization and Its Associated Factors among Pregnant Women in South Gondar Zone Northwest Ethiopia. The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children. The average cost for child care nationwide is over 12000 annually per child and has risen dramatically during the COVID pandemic.

If you pay more than 6000 in childcare costs dont use the dependent care FSA take the credit. Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. Up to 25 cash back Instead the dependent care contribution is subtracted from the child care credit 3000 - 2000 1000 allowing you to claim a child care credit of 20 of 1000.

The 20 credit would cut your tax bill by 1000 if you pay 5000 in. This will save you 5000 x 12 600 in federal. If you pay 6000 - 11000 in childcare costs you could put the difference between.

The 35 maximum credit applied to tax See more. The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA. Both the dependent FSA and child and dependent care tax credit provide tax advantages but they calculate their respective tax.

The expense limits are now 8000 for one dependent and 16000 for two dependents or more. Studies reveal child care expenses can. The credit rate you can claim based on your income has increased.

The child and dependent care tax credit covers similar expenses as the dependent care FSA. Child and dependent care tax credit. The child and dependent.

The higher your income the lower the credit bottoming out at 20 for those who earn 43000 or more. With the dependent care FSA you can put away up to 5000 for daycare expenses. Dependent Care FSA vs.

Dependent Care FSA. Unlike the dependent care FSA however. Dependent Care FSA vs.

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Will My Flexible Spending Account Show Up On A W 2

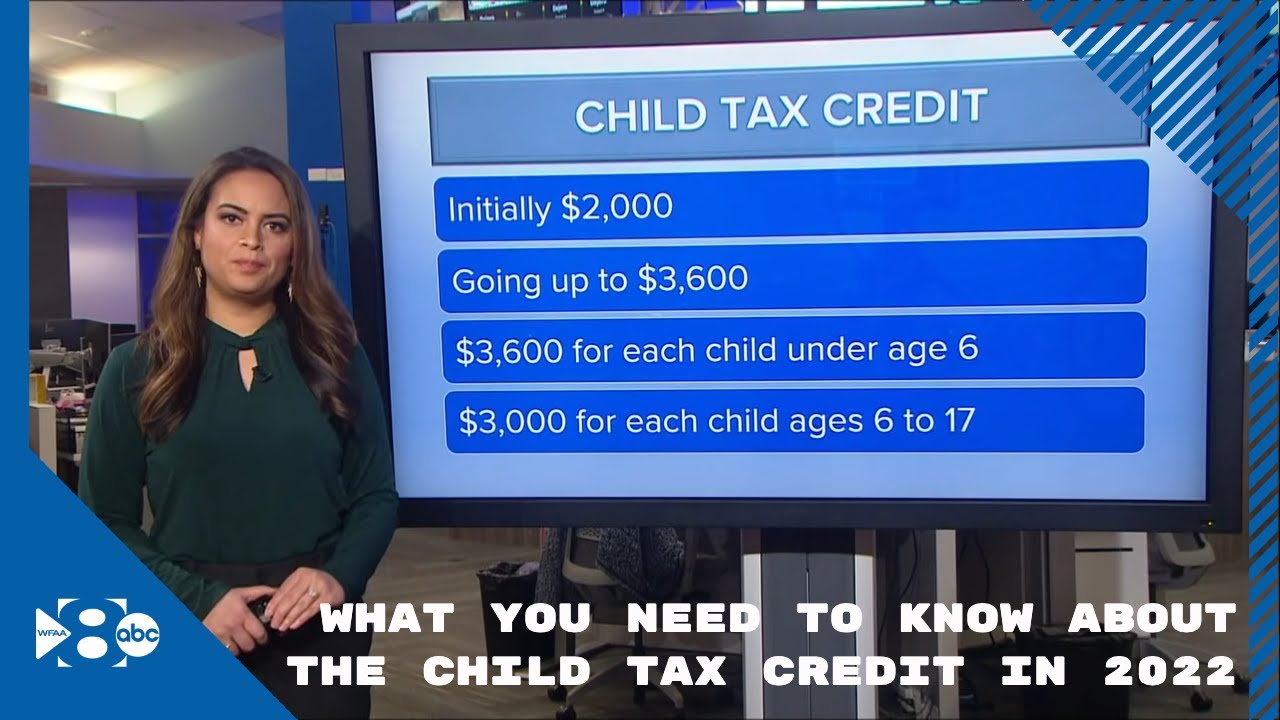

What You Need To Know About The Child Tax Credit In 2022 Youtube

Coh Dependent Care Reimbursement Plan

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Flex Spending Accounts Hshs Benefits

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor