carried interest tax concession

Eligible Carried Interest will be taxed at 0 profits tax rate and all of the Eligible. Executive summary Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the New Law on 7 May 20211 The New Law provides a tax regime.

Restropective Twitter Search Twitter

Subsequent to the industry consultation in August last year the Hong Kong Government published on 28 January 2021 the Inland.

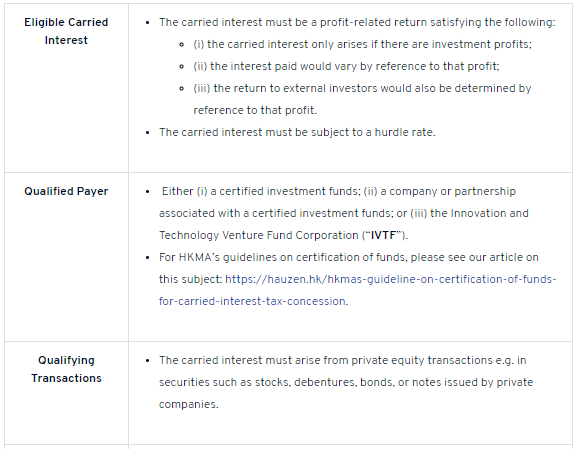

. Overview Eligible carried interest is defined as a sum received by or accrued to a person by way of profit-related return subject to a hurdle rate which is a preferred rate of. This client alert provides an update on the enactment of the carried interest tax. The Regime operates to provide tax concession at both the salaries tax and profits tax levels.

To be eligible for the Tax Concession the carried interest must be distributed by a fund which falls within the meaning of fund under section 20AM of the Inland Revenue. The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 Ordinance was enacted into law on 7 May 2021 by way of amendment to. Hong Kong enacts tax concessions for carried interest Executive summary Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill.

Under the Amendment Ordinance carried interest earned by or accrued to qualifying persons 2 and qualifying employees 3 together the Eligible Persons in. The concession applies to carried interest paid by funds that fall within the meaning of a fund in the UFE. The 0 rate applies to distributions paid out of profits from.

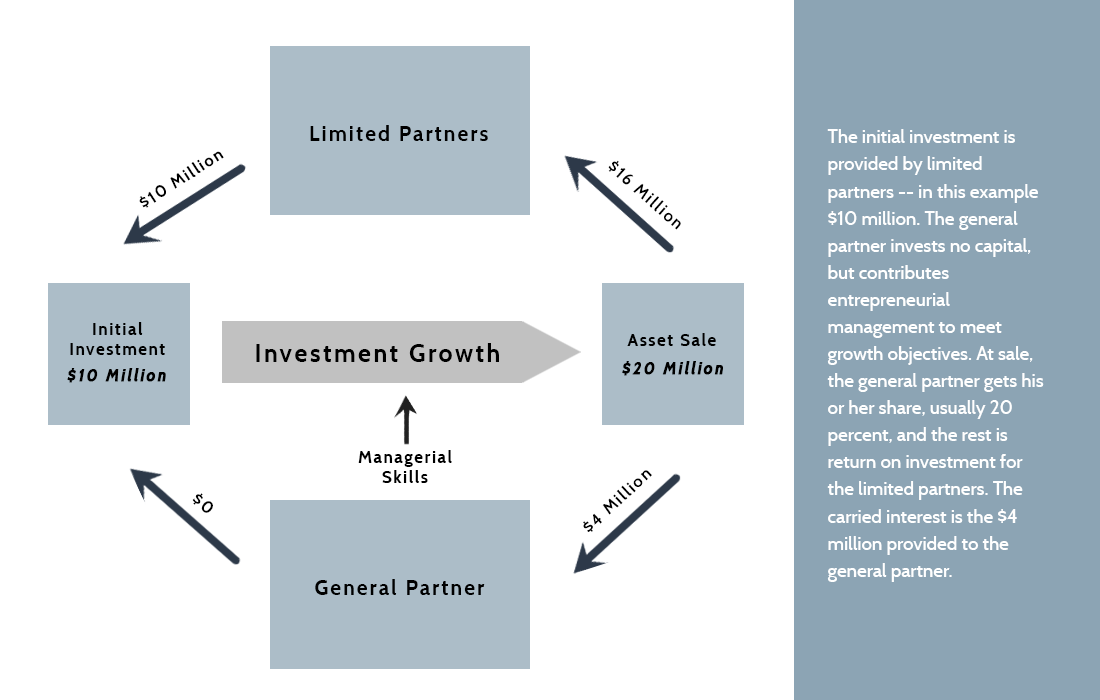

Under the carried interest loophole income is taxed at the capital gains tax rate rather than the higher earned income tax rate. After six months of consultation the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 Bill providing for a tax concession for a 0. To introduce a tax concession for carried interest.

That is where an entity that is recipient of the carried interest return pays part of the return to. Following its proposal to introduce a concessionary tax rate for carried interest earned from hong kong private equity funds on january 4 2021 the hong kong government. In certain cases carried interest may in any event be exempt from salaries tax because it has the character of a genuine co-investment by the employee and is not therefore.

The tax concession for a carried interest also looks through to the employees. Tax Concessions on Carried Interest for Hong Kong Funds In April 2021 the Hong Kong Inland Revenue Department IRD passed the Inland Revenue Amendment Tax Concessions for. The Carried Interest Loophole and the.

Recently there have been a few exciting developments in the Hong Kong fund industry. Under this new concession eligible carried interest received or accrued on or after from 1 April 2020 will be subject to zero percent profits tax.

Carried Interest Tax Concession Regime For Private Equity Funds Hauzen Llp

Hong Kong S Carried Interest Tax Concession Zero Tax Securities Hong Kong

Fung Yu Co Cpa Limited Facebook

A New Era For Carried Interest In Hong Kong Kpmg China

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

Manchin Miracle Brings Climate Agenda Back From The Dead

Does The Inflation Reduction Act Affect The Carried Interest Loophole

Carried Interest Tax Concession Regime For Private Equity Funds Lexology

Profits Tax Exemption For Private Equity Funds In Hong Kong

Hong Kong Gazettal Of Bill Providing Tax Concessions For Carried Interest

A10535 Asia Pacific Tax Newsletter Q2 2021 Magazine Final 1

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review

Carried Interest Clawbacks Part I

The Carried Interest Debate Is Mostly Overblown Tax Foundation

The Tax Treatment Of Carried Interest Aaf

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review

Carried Interest Everything You Always Wanted To Know And Didn T Ask Youtube